(Cash Basis vs Accrual Basis vs Modified Accrual Basis)

Choosing the correct accounting method for your business is very important. Not only does the IRS require a business to use a standardized and consistent accounting method but using a specific accounting method can help you assess your company’s financial situation more accurately and make better decisions.

If you are wondering, it is possible to change your accounting method in the future, but it is such a long, complex process. You can contact the IRS ahead of time and request permission to change accounting methods. You should be fine if you do so; however, failure to make the request may result in IRS penalties.

A change in accounting method includes the following:

- a shift in the overall accounting strategy for income and deductions; and

- a change to the treatment of any material item in the general accounting plan

Therefore, it is best to decide carefully at the start. This article will help you familiarize yourself with the different accounting methods, how they are used, and if they suit your business.

So what is the best accounting method for your business?

We will run through three types of accounting methods in this article to help you choose the right one.

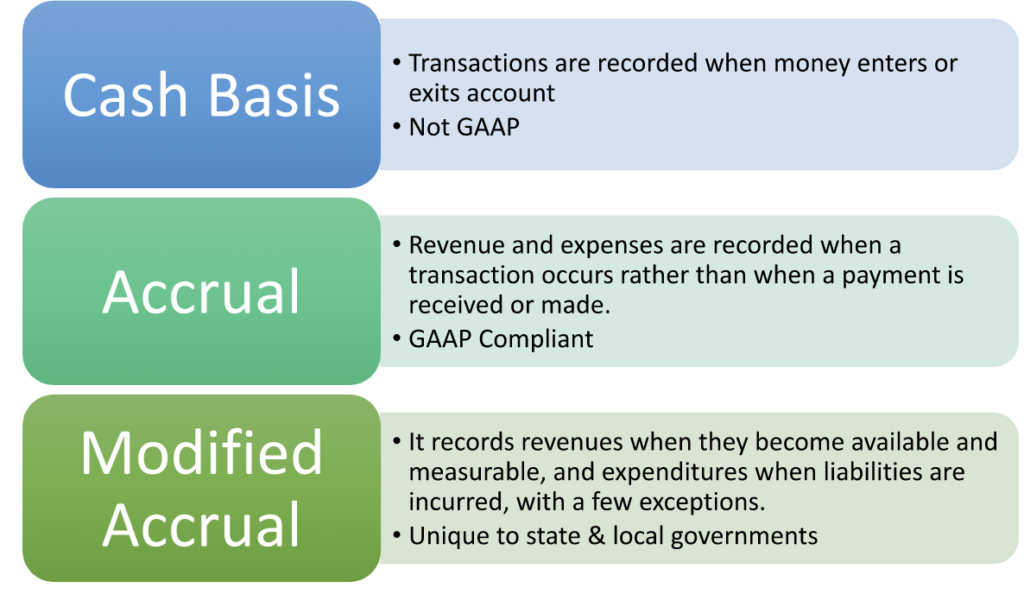

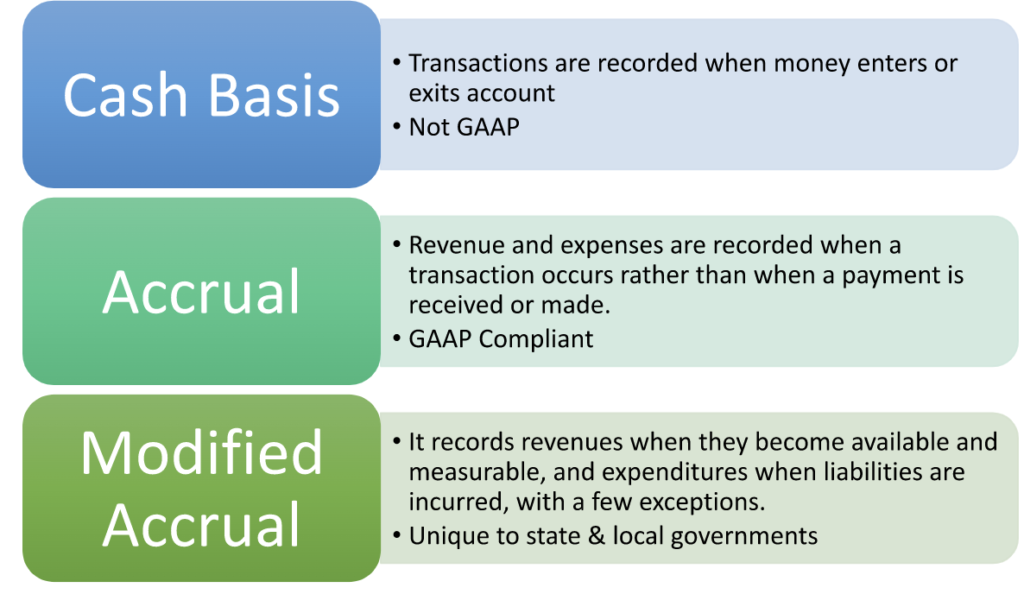

- Cash Basis Accounting

Cash-basis accounting is a method of accounting that is based on cash in and out. It is known as the checkbook method of accounting. Revenue is recorded every time you receive money, and an expense occurs whenever money is spent to pay for something.

Self-employed individuals and small business owners with no inventory typically use this method.

What’s the reason? It is the most basic accounting method. Cash basis accounting provides a quick snapshot of how much money the company has on hand.

It is a simple method that can be easily tracked. However, it only considers two types of transactions: Cash inflows and Cash outflows. A single-entry accounting system is used in this method because a single transaction record entry is made for each transaction. Because there is no tally of revenue and expenses in that accounting period, previous period comparisons are impossible.;

Here’s an example below:

Suppose Adrian owns a small clothing business and sold $5,000 worth of clothing on July 13th. The orders were made via Cash on Delivery. Though these purchases were made on the 13th, that day is irrelevant because the items were physically delivered on the 20th and were only actually paid for by then.

It is the same for expenses. If your business hires someone to do work, the expenses will be recorded once the payment has been made, not when the hiring or employment is incurred.

KEY TAKEAWAYS:

- Cash accounting is easy to understand. Transactions are only recorded when money enters or exits an account.

- Cash accounting is ineffective for larger companies or those with a large inventory because it obscures the true financial position.

- If you pay for something upfront, such as an annual insurance premium, cash accounting will not amortize those payments and some months will seem to be better or worse than they actually are.

- Accrual Accounting

The accrual method of accounting is significantly more complicated than the cash basis. To use this method, you should typically have some idea of accounting knowledge.

Accruals are expenses or revenues recorded by the business but have not yet been realized. The primary reason for using accrual accounting is to obtain a fair and accurate picture of the company at any given time.

You record income when the transaction occurs, even if you do not receive funds at that time. You must also record all expenses incurred, not just when they are paid.

It shows exactly what is happening in the business, not what it will achieve in the future.

This applies to medium to large business setups, mainly publicly traded companies. The accrual method is popular because it smooths out earnings over time by accounting for all revenues and expenses as they are generated. The cash basis method only records these when cash changes hands and can present more frequently changing perspectives on profitability.

Here’s an example:

Suppose a company purchases stocks on a credit basis from a supplier. This transaction is recorded after the purchase, even if the payment will be in the next month.

Suppose Adrian purchased $1000 worth of supplies for his clothing business from a supplier on the 22nd of July and agreed to pay for the whole next month. Here’s how it will be recorded:

| DATE | PARTICULARS | DEBIT | CREDIT |

| JULY 22 | Purchases A/c Dr | $1000 | |

| To Supplier – XYC Co A/c | $1000 | ||

| Being goods purchased on credit |

KEY TAKEAWAYS:

- Accrual accounting is a method of accounting in which revenue and expenses are recorded when a transaction occurs rather than when a payment is received or made.

- The matching principle states that revenues and expenses should be recognized in the same period.

- Modified Accrual Accounting (The Hybrid Method)

If you can’t decide between the two accounting methods mentioned above, the modified accrual accounting system tries to incorporate both the cash and accrual accounting systems. It attempts to maintain the convenience of the cash accounting system while incorporating the many sophistications of maintaining accounts under the accrual system.

It records revenues when they become available and measurable and expenditures when liabilities are incurred, with a few exceptions. It accomplishes this by categorizing different transactions as long-term or short-term.

- Long-term transactions occur over multiple accounting periods, whereas short-term transactions occur within a single accounting period.

- Short-term transactions are recorded as if the accounts were kept in a cash accounting system under the modified accrual accounting system. Long-term transactions, on the other hand, are recorded using the accrual method. It is a recognized method for recording government accounts but not for commercial institutions.

Government agencies use and accept modified accrual accounting because it focuses on current-year obligations. Government agencies have two main goals: to report whether current-year revenues are sufficient to cover current-year expenses and to demonstrate that legally mandated budgets are using resources.

However, it is essential to note that modified accrual accounting is not recognized as a proper system by the International Financial Reporting Standards (IFRS), to which most businesses adhere. That is why companies commonly use the accrual accounting system.

KEY TAKEAWAYS:

- Modified accrual accounting is a system that combines accrual and cash basis accounting.

- This accounting system combines the ease of use of cash accounting with the more sophisticated ability of accrual accounting to match related revenues and expenses.

- Whether long-term or short-term assets, modified accrual accounting borrows elements from cash and accrual accounting.

- Although companies cannot use this accounting method for financial statements, it is widely used by government agencies.

Accounting Methods Comparison

Now that we’ve covered the different types of accounting and the three accounting methods let’s get to the big question.

How do you know which type and method of accounting to use?

Each of the three accounting methods has advantages and disadvantages. However, most financial regulatory frameworks require the books of accounts to be kept following the accrual accounting system.

Fortunately, the IRS establishes guidelines for who can and cannot use each method.

In general, most businesses can use whatever accounting method they want. However, according to IRS regulations, larger companies cannot use the cash basis or hybrid method.

But what exactly is a larger business? You cannot use cash-basis or hybrid method accounting if your business is:

- A corporation or a partnership (other than an S corporation) with average annual gross receipts of more than $25 million in the three preceding tax years.

- If your business is defined as a tax shelter.

- If the IRS defines your business as a qualified personal service corporation.

Conclusion

When comparing accounting methods for your company, you’re not just deciding between cash-basis and accrual-basis accounting. Instead of choosing between the two, you can take a hybrid approach if it fits your financial situation. You can use one method for tax returns and another for financial statements.

Consider the following factors when determining which method is best for your company:

- the size of your business

- how complex your business transactions and processes are

- whether you can manage accrual accounting

- Will using an electronic system make a difference?

Remember that the IRS requires taxpayers to use an accounting method that accurately captures their income consistently. Consistency is critical because changing accounting methods can create loopholes that companies can exploit to manipulate revenue and eventually supplant tax burdens.

You must stick with the method you choose for at least a year. You cannot switch midstream but can make changes in a new tax year.

Contact us if you need help deciding on the best accounting method for your company or want to learn more about it.