Guide to Small Business Bookkeeping

Bookkeeping is an essential component of managing a business. When starting a business, it’s one of the first things you should do. If you’re not doing it, you’re losing out on crucial information about your company that could help in its expansion and growth. Still, if you are unfamiliar with the process, bookkeeping might be scary.

The purpose of this guide is to show you how to begin bookkeeping, what kinds of data are available, and how to use them wisely in your small business.

Before we jump on it, let’s talk about what bookkeeping is.

Overview

Bookkeeping is the process of tracking financial transactions in order to determine which expenses should be paid and which accounts need to be reconciled. The goal of bookkeeping is to ensure that the money coming into your business and going out is accounted for correctly, so that you can track performance metrics and make informed decisions about where to invest resources.

Here are some basics to keep in mind:

• It’s important to maintain accurate records. You should make sure that everything is labeled, date-stamped, and signed.

• At least three separate books should be kept: one for cash flow (what comes in and goes out); one for accounts receivable (who owes you money), and one for accounts payable (who you owe money).

• You should keep track of your expenses as well to avoid any confusion between them and your income.

What Differentiates Bookkeeping from Accounting?

Every financial transaction supporting paperwork is gathered by a bookkeeper, who then enters it in the accounting journal, categorizes it as one or more debits and one or more credits.

All financial transactions are documented, but they must be compiled at the conclusion of particular time frames. Some businesses call for quarterly reports. Other smaller businesses might only ask for reports at the end of the year to prepare for filing taxes.

The accountant is the one that assumes control and begins reviewing, interpreting, and reporting financial data for the business. The accountant also creates the correct accounts for the company and year-end financial statements.

What are the requirements for setting up Bookkeeping in your Business?

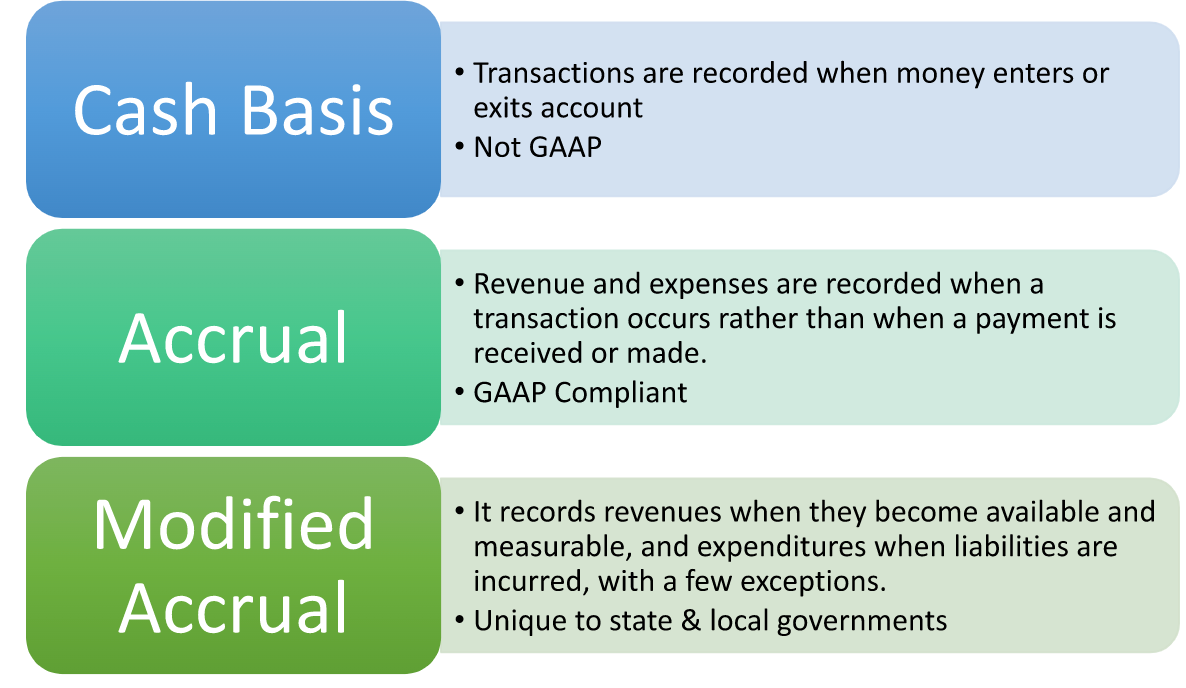

- Cash Accounting VS Accrual Accounting

Choosing between a cash and accrual accounting system is one of the first choices you must make when setting up your bookkeeping system.

If you use cash accounting, a transaction is recorded When cash is exchanged, on the other hand, accrual accounting allows you to record purchases & sales right away, even if the money doesn’t get exchanged until later.

Occasionally, small businesses start out using cash accounting and transition to accrual accounting as they expand.

NOTE: You must adopt an accrual accounting system if you intend to extend credit to your clients or ask for credit from your suppliers.

- Single-entry VS Double-entry Bookkeeping

As a small business owner, you must also choose between single-entry and double-entry bookkeeping.

The traditional single-entry method of bookkeeping does not adhere to a fixed set of accounting principles. Its feature is that of like a checkbook, only one entry is made for each transaction, whether it be a cost or an income transaction

Sample Single-entry:

DATEDETAILACCOUNTAMOUNTJULY 22BANK LOAN PAYMENT 000123456350JULY 22PURCHASE OF STOCKSIT0123239

Double-entry is a method of keeping records in which the two-sided effects of a transaction are recorded in the appropriate accounts, creating an overall balance. Therefore, there should be an equal and comparable credit record or entries for every debit.

Sample of a Double-entry:

DATEDETAILACCOUNTDEBITCREDITBALANCEJULY 22STARTING BALANCE2000JULY 22RENTIT01238001200JULY 23SALESIT01255501700

With the ease of off the shelf softwares such as Xero and Quickbooks, double entry accounting is largely automated and is the recommended method.

- Familiarize yourself with Bookkeeping Terminologies

Here are some of the basic terminologies every small business owner should know:

- Balance Sheet – the financial statement that gives an overview of the business’s financial situation as of a specific date. The reason it’s called a balance sheet is because the company’s assets and liabilities must be equal (liabilities and equity).

- Assets – All the assets that your business has in order to properly operate its business, including money, structures, land, equipment, tools, vehicles, and furniture.

- Liabilities – All of the business’ outstanding debts, including bonds, loans, and unpaid payments.

- Equities – all of the capital that the business’s owners have invested. The owner’s equity is displayed in a Capital account of a small business that is owned by one person or a group of people. Shares of stock are used to represent owner equity in larger, incorporated businesses.

- Accounts Payable – The account used to keep track of all unpaid invoices from suppliers, contractors, consultants, and any other businesses or people the business purchases goods or services from.

- Accounts Receivable – The account used to monitor all store credit sales made by clients. Instead of credit card sales, store credit refers to transactions when the retailer directly extends credit to the customer and must eventually recover payment from the client.

- Record Transactions Correctly

Transactions must always be accurately recorded. This will help you not only in legal matters, but it may also help you avoid any conflicts with your clients.

Expenditure & Billing

To make sure you are charging and getting charged fairly, transactions should be recorded. Everyone, including your consumers, hates unneeded expenses. Transactions should never be greater than what you anticipated.

Legal Documentation

Transaction recording will significantly help with legal requirements, including your tax returns! Your money must be documented when running your own firm, whether it is private or public.

- Reconcile your Bank Accounts

A bank reconciliation statement is a document that compares a company’s cash balance on its balance sheet to the amount on its bank statement. Reconciling the two accounts aids in determining whether accounting changes are required. Bank reconciliations are performed on a regular basis to ensure that the company’s cash records are accurate.

This often gets overlooked by businesses but it is super helpful to perform. They also aid in the detection of fraud and cash manipulation by being able to determine whether any customer checks have bounced, or whether any checks you issued were altered or even stolen and cashed without your knowledge.

- Run Financial Statements

Financial statements are essential. They contain vital information about a company’s financial health and operations. Financial statements assist businesses in making informed decisions. They highlight which areas of the business provide the greatest return on investment.

What is a financial statement, you ask?

A financial statement summarizes a company’s financial performance over a specific reporting period. It is frequently included in the annual report and is divided into three sections. These consist of assets, liabilities, and equity. These sections are further subdivided into subsections. Current assets/liabilities, long-term assets/liabilities, revenue sources, and expenses are examples of these.

Financial statements require a solid understanding of finance and accounting standards. You may choose to seek the advice of a professional when preparing your financial statements or look for the best softwares that will cater your needs.

THE BEST BOOKKEEPING SOFTWARES IN THE MARKET

Depending on your business needs, here are some of the bookkeeping softwares that make it easy for business owners like you!

- The most thorough DIY program is QuickBooks

- Depending on the features you need, you’ll want one of QuickBooks’ four monthly plans:

- Simple Start – $25 per month for basic features such as income and expense tracking, invoicing, general reports, and sales and sales tax tracking.

- Essentials – $50 per month for everything in Simple Start, plus up to three users, time tracking, and bill pay.

- Plus – $80 per month for everything in Essentials, plus up to five users, inventory tracking, and project profitability tracking.

- Advanced – $180 per month for advanced features, including up to 25 users, automation, a dedicated accounts team, and exclusive premium apps.

QuickBooks Online is a great place to start if you want to streamline your bookkeeping and accounting.

- FREE alternative: Wave Accounting (who doesn’t like FREE?)

- Besides the free accounting features, Wave offers additional paid features as follows:

- Payment Processing – 2.9% + 30¢ per transaction for Visa, Mastercard, Discover; 3.4% + 30¢ per transaction for American Express; 1% ($1 minimum fee) per ACH bank payment.

- Payroll – $20 or $35 monthly base fee (depending on what state your business operates in) + $6 per active employee and $6 per independent contractor paid.

Wave offers a nice balance for those who want to keep accounting costs low while still having access to additional features if needed.

- Best for small businesses & ecommerce: ZohoBooks

- It supplies user-friendly online accounting software. To assist you in automating your bookkeeping and financial procedures, it interfaces with other Zoho solutions as well as other financial services. Utilize the tool to manage estimates, purchase orders, invoices, and other tasks. A client portal and a vendor portal are accessible for simple management of clients and vendors.

- For companies making up to $50,000 annually, a free subscription with one user and one accountant is offered. Paid subscriptions begin at $15/month when paid annually.

Beginners may find bookkeeping complicated. However, most internet accounting software programs have made it simple to manage the fundamentals of bookkeeping requirements.

If you’re still unsure how to handle it, you may call us and we can help you with your bookkeeping needs.