The Benefits of Regular Bookkeeping

Running a successful business takes time, perseverance, and dedication. Many business owners become so consumed with generating their first sale or hitting a large milestone that they neglect the basics.

Regular bookkeeping is vital to long-term success and scalability, leading to improved cash flow, the promotion of financial transparency, more informed business decisions, a reduction of fraud risk, and timely tax remittances.

Improve Cash Flow

The first benefit of regular bookkeeping is improved cash flow. A lack of control surrounding cash flow is one of the top causes of business failure. Effectively controlling the money flowing in and out of your company helps you make more informed business decisions, such as waiting until you receive a customer deposit to pay your suppliers when your cash balance is low.

When you prioritize cash flow, you won’t have to worry about bouncing payments to suppliers and employees. Instead, you will have the funds on hand to meet all upcoming obligations and even reinvest back into the business.

Promote Financial Transparency

Financial transparency is an area that many business owners struggle to properly maintain. How much profit do you have this year? What upcoming payments does your business need to budget for? If you can’t easily answer these questions, it may be time for a change.

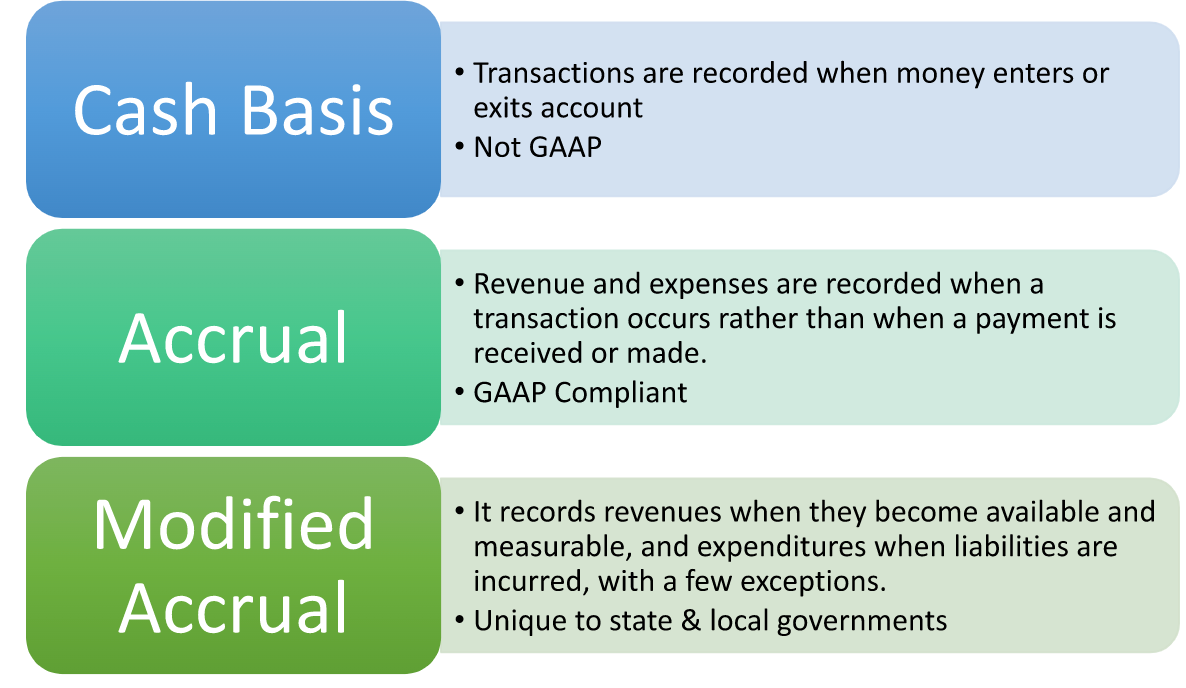

Regular bookkeeping helps ensure that all of your transactions are recorded and properly classified. This then produces accurate financial reports that you can review to uncover areas of improvement or gauge where your business health falls.

Create Informed Business Decisions

More informed business decisions lead to growth. Deciding when to purchase that new piece of equipment or hire an additional employee takes careful consideration of your cash flow, upcoming liabilities, and the direction you want to take your business.

Completing regular bookkeeping gives you the tools and insight needed to fully understand your financial situation. For example, you may think that your business is growing and generating revenue, but the financials might tell you another story. Being aware of the financial details of your business with the help of bookkeeping is critical as a business owner.

Reduce the Risk of Fraud

Fraud is a risk that every organization faces, from the small mom-and-pop shop to the large enterprise. When you have no controls surrounding your cash account, you are giving your employees the opportunity to commit fraud. Regular reconciliations help prevent and detect fraud, securing your financial assets.

When fraud goes undetected for a long period of time, the employee may have already left and caused your business a large financial loss. Uncovering the fraud timely should remain a top priority for all business owners.

Properly Prepare for Year-End

Year-end approaches rapidly for all business owners, from preparing the final set of financials to filing the tax returns. When you don’t have regular bookkeeping done throughout the year, it can take hours or even days to get caught up, increasing your risk of mistakes and errors. The IRS and state agencies don’t take misreporting lightly, leading to high fines and penalties or even business closure, making it critical to keep track of your transactions throughout the year.

Next Steps

Does regular bookkeeping sound like something your business can benefit from? Trying to handle the bookkeeping function on your own can be stressful and time-consuming, which is why many business owners pass the burden off to a professional, like Gordian Financial. At Gordian Financial we strive to provide your business with value through regular bookkeeping done by our team of experts.

Reach out today to set up a consultation.